May 2, 2025

What a difference a few weeks can make. While the financial media was expecting continued calamity and downside in the stock market in early April, the S&P 500 now sits at about where it was before the big drop that started on April 3rd. Does this mean we are out of the woods now and all clear? I don’t see it that way yet as it will have a lot to prove on a technical basis as the S&P 500 has entered the resistance zone I mentioned in my previous newsletter. While some charts suggest more upside is possible, others suggest continued caution.

You can see in the chart above the S&P 500 still sits below its 200-day moving average (red line). That area is where the market stalled in late March that eventually led to the big drop in early April. It is also the area where the market found resistance last July and August before pushing through. How it reacts from here will be important. It very well could slice right through and continue to push all the way to new highs. I would expect some volatility here though as it deals with this area of resistance. A drop that forms a higher low from where it was in mid-April would be a positive development and could lead to a new uptrend beginning. If not then it could very well have another leg down taking out the lows at 4800 later this year.

Some of the more aggressive areas of the stock market have started to catch a bid. We are in the middle of quarterly earnings season with most of the big technology stocks reporting quarterly earnings this week. So far we’ve seen positive reactions in price from most of them as they continue to beat estimates. This is a positive sign as investors begin to feel more comfortable taking risk. If the market continues to push higher we want to see the aggressive areas like technology and consumer discretionary lead the way. So far this bounce in the market from early April has not been led by the big tech stocks until recently.

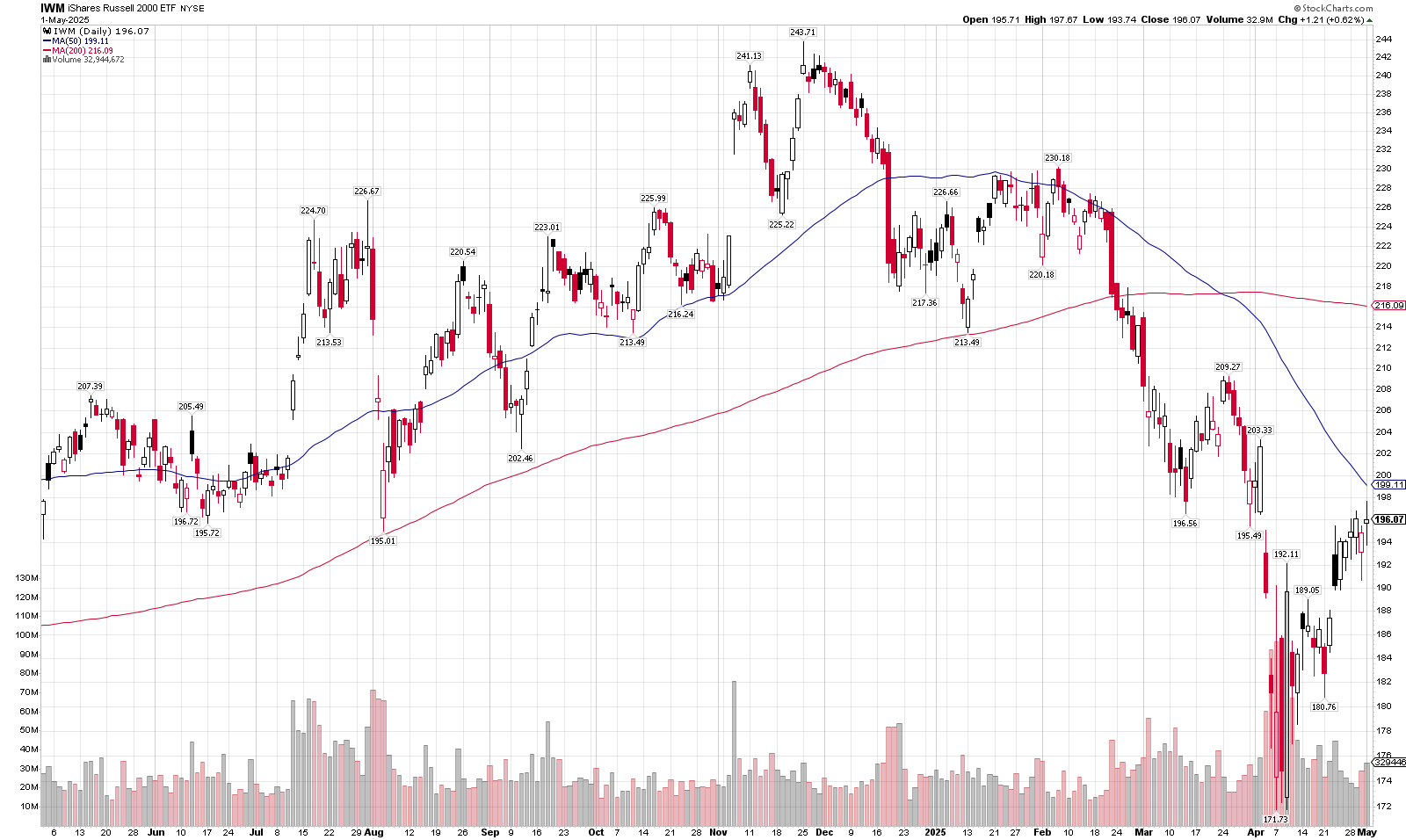

An area of the stock market that continues to struggle is small caps. I’ve highlighted their importance before as it relates to market leadership and the economy. You can see from the chart below that it too has bounced since early April, but not to the degree that we’ve seen in the S&P 500. Small caps remain almost 20% from their highs last November. Its continued under-performance puts into question how much time is left in this economic cycle.

High-yield bonds are another area to watch. High-yield bonds, or what some may call junk bonds, are bonds issued by companies that have low credit ratings. So, they must offer higher yields on their bonds to entice investors to purchase their bonds despite the higher credit risk. The chart below shows an ETF (exchange-traded fund) of a high yield bond fund that holds a basket of those types of individual bonds. Prices often will mimic the stock market and right now it’s not far off of its highs from the end of February. If investors were concerned about the economy and markets you would expect this to be struggling. So far it has held up well and is a positive signal for the stock market and risk taking if it continues to push to new highs.

What the treasury bond market and interest rates have done this year has been unusual and not typical of a risk-off move. Rates on the long end of the curve have been almost as volatile as the stock market. The 10-year Treasury rate moved higher early in the year to over 4.8% before falling to almost 3.8% in early April. It then quickly jumped in just a few days back up to almost 4.5%. In a normal risk-off environment you see long-dated Treasury rates fall as demand goes higher for the safety of the U.S. government. During the panic in the markets in early April that was not the case.

The government certainly needs lower rates as it is estimated that $28 Trillion (!) of its debt will need to be refinanced over the next 4 years. While the Federal Reserve may want you to think they have control of the bond market and interest rates, they really do not. The short end of the curve they will have influence on with their benchmark rate. The farther out on the curve the less influence they have and the more market forces take effect. The problem the government has right now is its interest expense. They can attempt to control the deficit and spending but they can’t control what their interest expense will be. As new debt is issued at higher rates, more debt has to be issued just to service that debt (pay the interest). Obviously a cycle that will be difficult to get out of as tough decisions will eventually have to be made by politicians. Rates could continue to go up as investors demand a higher risk premium to hold these treasury bonds to maturity knowing the debt and deficit problems of this country.

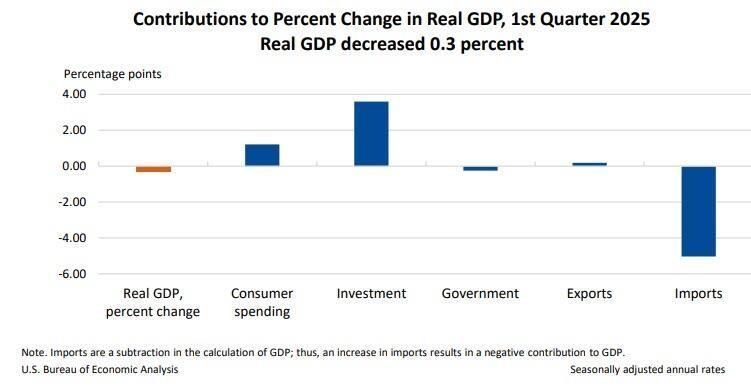

With the stock market dropping quickly in early April, more and more headlines came out about recession being on the horizon. While a slew of economic indicators have been pointing to recession for going on 3 years now, the economy has just continued to chug along. Lots of economic data has come out over the last week including the first quarter GDP (gross domestic report) report. With the headline number coming in negative (-0.3%) it makes you believe recession is imminent. But when you dig into the reading it actually doesn’t necessarily portray that. Net trade is the main reason for the negative print. As businesses loaded up on imports in the first quarter to get ahead of tariffs, it resulted in a large drop in net trade (exports less imports). This caused about a 5% hit to the GDP number for the first quarter. You can see the different components to the GDP below. Consumer spending makes up most of the GDP calculation. While it has slowed it does remain positive but will be important to monitor along with the jobs market/unemployment.

Overall, I believe it is important to keep an open mind. This stock market has been resilient over the last 15 years as it has faced other extreme uncertainties and found a way to continue climbing the wall of worry and extending this long-term bull market. Could this time be different? The combination of what the technical signals are showing and some of the more fundamental expectations would advise continued caution, but we always must be prepared to pivot.

Cory McPherson is a financial planner and advisor, and President and CEO for ProActive Capital Management, Inc. He is a graduate of Kansas State University with a Bachelor of Science in Business Finance. Cory received his Retirement Income Certified Professional (RICP®) designation from The American College of Financial Services in 2017.

DISCLOSURE

ProActive Capital Management, Inc. (PCM”) is registered with the Securities and Exchange Commission. Such registration does not imply a certain level of skill or training.

The information or position herein may change from time to time without notice, and PCM has no obligation to update this material. The information herein has been provided for illustrative and informational purposes only and is not intended to serve as investment advice or as a recommendation for the purchase or sale of any security. The information herein is not specific to any individual's personal circumstances.

PCM does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional.

All investments involve risk, including loss of principal invested. Past performance does not guarantee future performance. This commentary is prepared only for clients whose accounts are managed by our tactical management team at PCM. No strategy can guarantee a profit.

All investment strategies involve risk, including the risk of principal loss.

This commentary is designed to enhance our lines of communication and to provide you with timely, interesting, and thought-provoking information. You are invited and encouraged to respond with any questions or concerns you may have about your investments or just to keep us informed if your goals and objectives change.