April 30, 2024

So far 2024 has seen consistent higher than expected inflation numbers in several different readings. As mentioned in the newsletter at the end of 2023, the expectation was for the Federal Reserve to be cutting interest rates throughout this year as inflation continued to cool off towards the Fed’s preferred 2% target. Rate cut expectations/odds have decreased substantially this year. Some that were expecting up to 6 rate cuts this year are now expecting just 1, or possibly none. We’ll get to know more of the Fed’s thinking as they meet this week and will have any adjustments announced on Wednesday, May 1st.

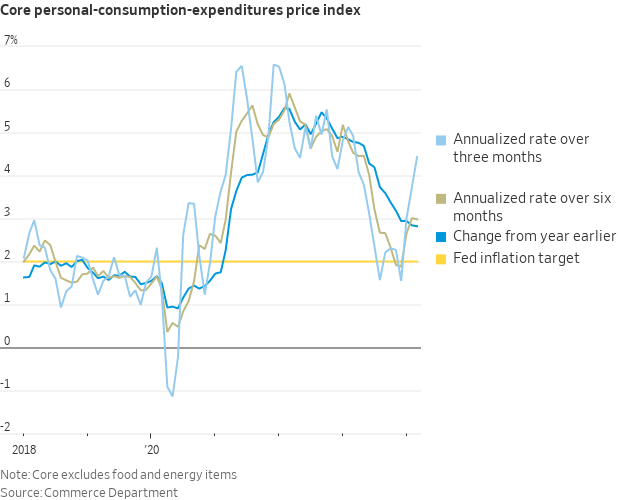

The chart above shows the CPI (Consumer Price Index) starting to uptick so far in 2024 after the annualized rate stabilized around 3.5% in the second part of 2023. Annualized monthly readings so far in 2024 are approaching 5%. Other inflation readings, like the PPI (Producer Price Index), and the PCE (Personal Consumption Expenditures), also continue to print higher numbers than expectations. The PCE is known as the Fed’s preferred inflation reading. The chart below shows the uptick recently, with the 3-month annualized rate jumping to 4.4% for Core PCE. Core excludes food and energy items, which if you’ve been to the grocery store or gas pump, you know those prices have gone up as well.

This continues to put the Fed in a tough spot. While the economy continues to remain quite strong with low unemployment, the Fed thought going into this year that they would be able to achieve their proverbial “soft landing” of the economy. If they are forced to keep interest rates higher for longer, or even surprise everyone and possibly raise them even further, it will continue to put pressure on the economy. This would make it harder for them to achieve their “soft landing”.

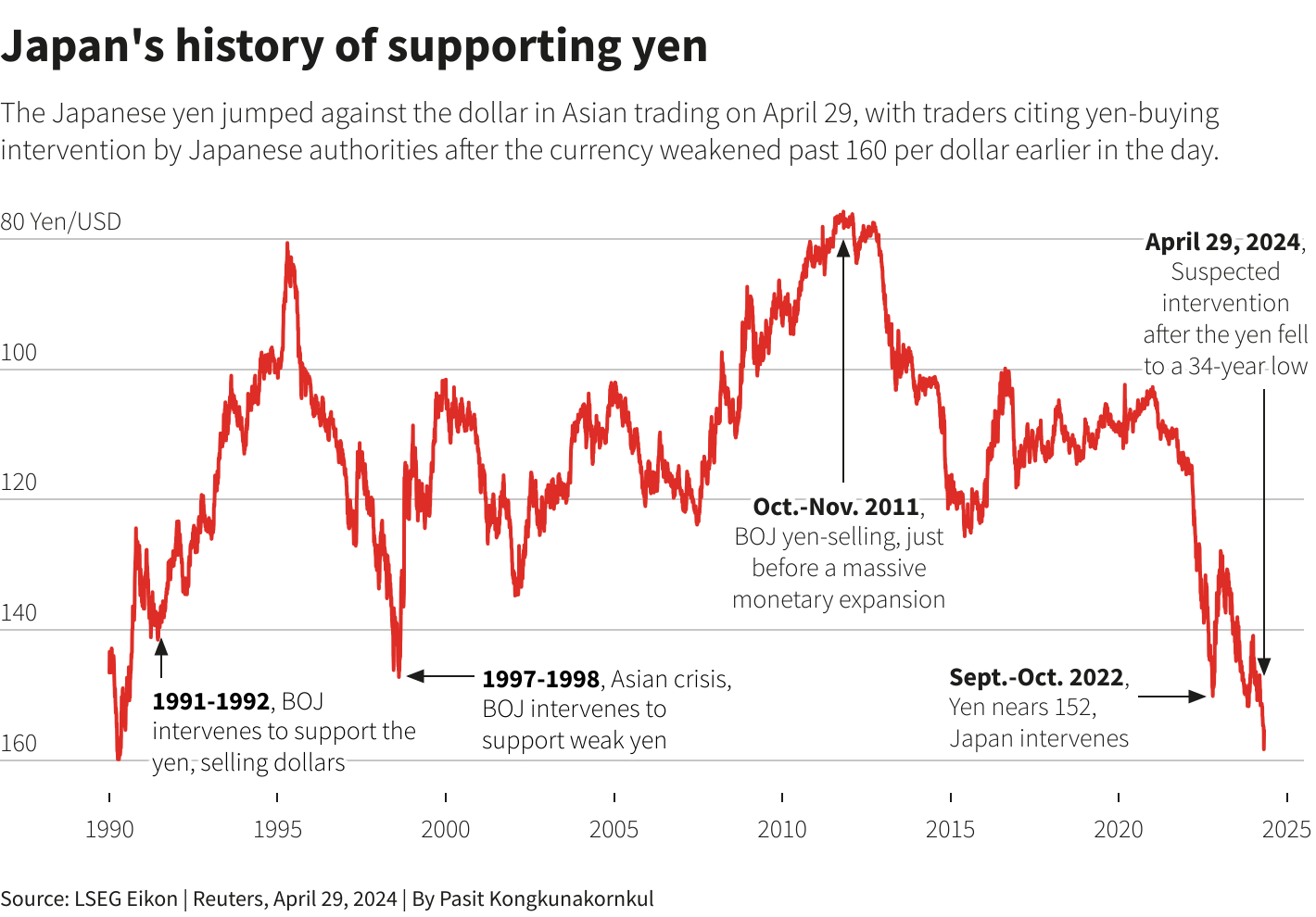

Another area that could affect interest rates and policy here is actually foreign to the U.S., and that is the Yen, Japan’s currency. You probably won’t hear about it on the nightly news, but it is beginning to gain more traction in economic headlines. Currently the Japanese Yen is hitting its weakest levels relative to the U.S. Dollar in 34 years and has lost 11% against the dollar so far this year. Japan has had a zero-interest rate policy for many years, and with higher interest rates here in the U.S. over the last few years, it has created what’s called a “carry” trade. This is where you can borrow money in Yen and invest in U.S. Treasuries at a higher rate. Japan has been the largest foreign holder of our treasuries. A weakening of their currency has kept pressure on rates here to remain high.

What could play out is the Bank of Japan (BOJ) stepping in to try and support its currency. A weak Yen carries the risk of causing higher inflation in Japan. If the BOJ decides to begin raising interest rates and shift away from their zero-rate policy, you could begin to see an unwind to the carry trade and the selling of U.S. treasuries as Japanese begin to bring their money back home. The BOJ though has been reluctant to raise interest rates and have maintained a zero-rate policy.

As I’ve highlighted in newsletters over the last year, the banks continue to be a concern. The first bank failure of 2024 occurred this last weekend with Republic First Bank, a regional bank based in Philadelphia. The failure is expected to cost the deposit insurance fund of the FDIC $667 million. High interest rates and falling commercial real estate values continue to put stress on banks. The stock of New York Community Bancorp, which I highlighted last month, continues to languish near its lows. The regional bank ETF, shown below, remains off its lows from last year but is beginning to show signs of continuing its longer-term downtrend. It remains well off its highs from early 2022.

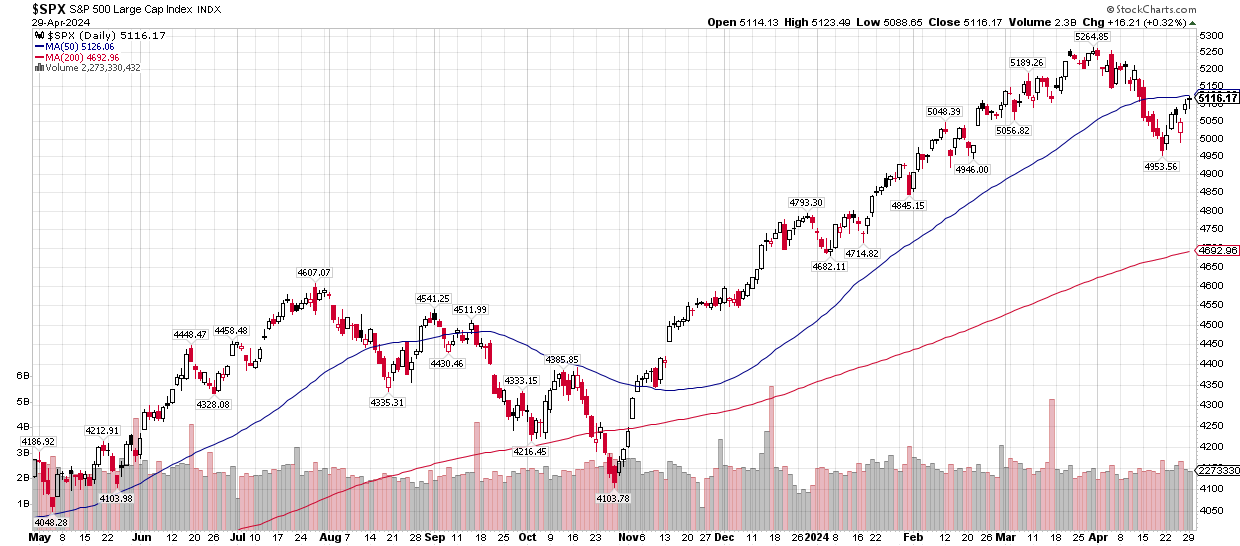

With tensions overseas heating up early this month, along with the realization of higher interest rates for longer, the stock market has seen a drop since the first of April. It sliced right through initial support but has since bounced to end the month on a better note.

Resistance for the market is near the 50-day moving average now in the range of 5100-5150. If it can conquer that area, then odds suggest this uptrend that started in early November can continue with higher highs to come. A failure from here, though, and this correction/drop has more to play out. There’s a lot of air between the current price and the 200-day moving average at around 4700. A drop to that area, similar to the correction last year in late summer/early fall, would not be out of the ordinary.

While there may be several risks in the current environment, the market often will climb the wall of worry. Which is why I continue to base decision making on the charts and what I see, rather than what I hear on the news or in headlines. Many times, an event will happen with the market reaction being the opposite of what the masses expect.

In closing, I wanted to announce the retirement of Jim Reardon. As many of you may have already heard, Jim is calling it a career and looking forward to spending more time with family and traveling. I’ve enjoyed working with Jim now for almost 7 years and grateful for all the knowledge and insight he has passed on. Our company’s history goes back to Jim’s decision to start his own independent firm called Peoples Wealth Management in 2003. It was his vision of managing risk through market cycles and commitment to “preserving capital and making it grow” that laid the foundation for where the company is today. We all wish Jim a happy retirement!

As always, reach out with any questions or concerns.

Cory McPherson is a financial planner and advisor, and President and CEO for ProActive Capital Management, Inc. He is a graduate of Kansas State University with a Bachelor of Science in Business Finance. Cory received his Retirement Income Certified Professional (RICP®) designation from The American College of Financial Services in 2017.

DISCLOSURE

ProActive Capital Management, Inc. (PCM”) is registered with the Securities and Exchange Commission. Such registration does not imply a certain level of skill or training.

The information or position herein may change from time to time without notice, and PCM has no obligation to update this material. The information herein has been provided for illustrative and informational purposes only and is not intended to serve as investment advice or as a recommendation for the purchase or sale of any security. The information herein is not specific to any individual's personal circumstances.

PCM does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional.

All investments involve risk, including loss of principal invested. Past performance does not guarantee future performance. This commentary is prepared only for clients whose accounts are managed by our tactical management team at PCM. No strategy can guarantee a profit.

All investment strategies involve risk, including the risk of principal loss.

This commentary is designed to enhance our lines of communication and to provide you with timely, interesting, and thought-provoking information. You are invited and encouraged to respond with any questions or concerns you may have about your investments or just to keep us informed if your goals and objectives change.