August 23, 2024

Since my last newsletter, the market has seen quite the roundtrip in price and volatility. A drop of about 8% in the S&P 500 over a 3-day period at the beginning of August sent volatility readings spiking. Since then, though, the market has erased that decline and is now nearing its highs from mid-July. Volatility is now back near levels it was prior to the drop. Market commentators have placed many different reasons for why that drop occurred, be it Federal Reserve policy, the Japanese markets and currency, or even the weak jobs report from July. Sure, those had an effect on the market, but overall, it was due for some type of drop or correction. Is all well going forward through the end of the year? The rally off the lows has been a bit of a mixed bag, with some signals showing strength and others being weak for this big of a rally. Seasonality wise, we are coming up on a typically weaker time period for the market in September.

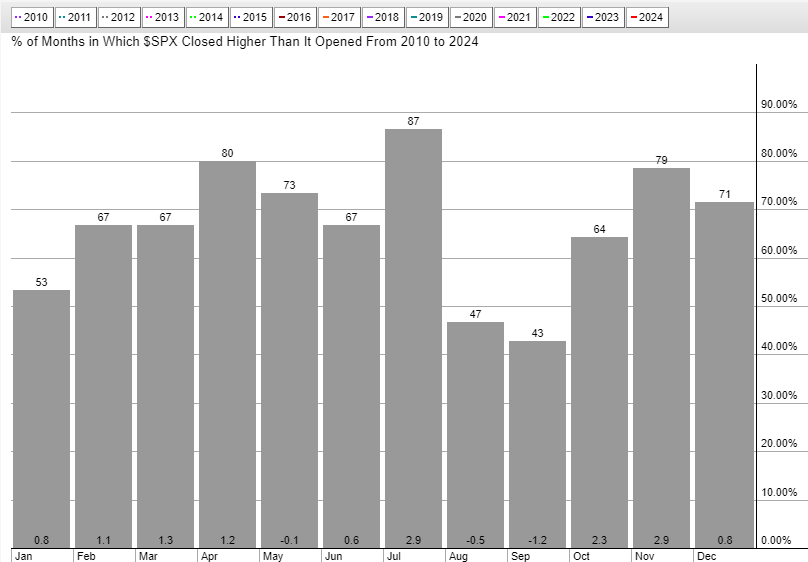

As you can see above, September has been the weakest month of the year over the last 15 years, generating a positive return only 43% of the time and averaging a negative return. In fact, each of the last 4 years has seen a negative return in the month of September. October has historically been a weak month as well in election years. It has also been the month for surprises and market “events” in the past.

If we see a corrective phase continue for the market over the next 2 months, it could set up a post-election rally into year-end. That would be typical of an election year. The one thing that could throw a wrench into that would be the economy. The one part of the economy that has remained strong despite high inflation and high interest rates over the last couple of years has been the labor market. There continues to be signs, though, that it is cracking.

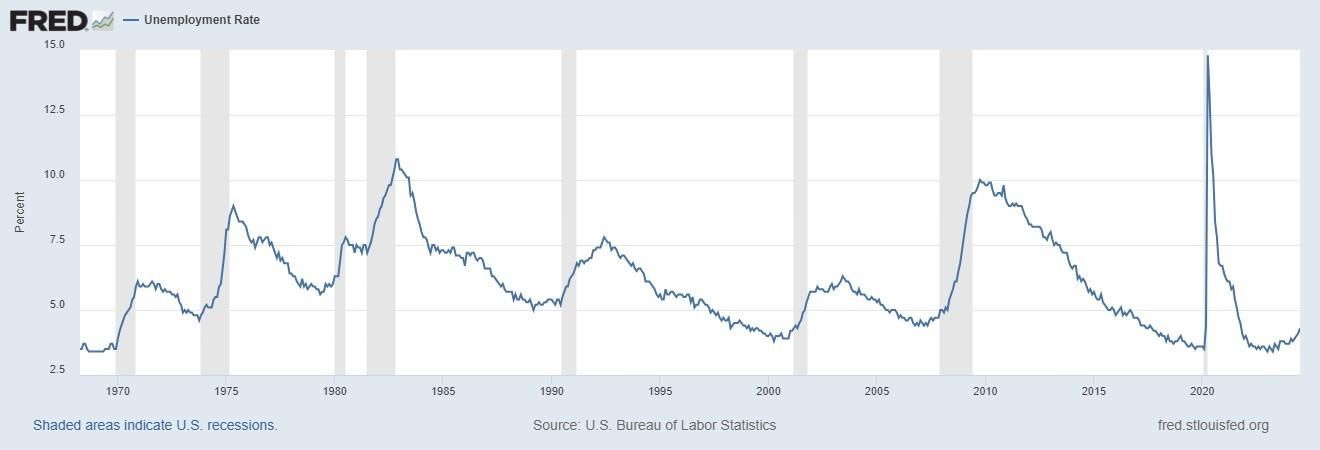

The July jobs report that came out on August 2nd surprised investors and economists, as job growth totals for the month were much less than expected and the unemployment rate edged higher again, to 4.3%. Job growth of 114,000 for the month was below the estimated 185,000. Previous months job growth numbers were also revised lower by 29,000, and 5 of the past 6 months have seen job numbers get revised lower after the fact.

As you can see above, the unemployment rate continues to trend higher. One thing that can be seen with the unemployment rate over the last 50+ years, is that when it begins to trend higher, it usually ends in recession. The rate does not stagnate and typically is either trending higher or lower. While 4.3% is historically very low, the trend is not our friend currently. One indicator to measure this trend and potential for recession is called the “Sahm Rule”. This rule is triggered when the 3-month moving average of the unemployment rate exceeds the lowest point over the previous 12-months by 0.5%. This was triggered with this latest increase in the unemployment rate, and each time it has triggered since 1960 it has resulted in recession.

A common criticism of the Sahm Rule and why some economists disregard it for today’s environment, is that it can be distorted by changes in the labor force participation rate. A larger share of the rise in unemployment than normal has come from re-entrants or new entrants into the labor force over the last year. This can be stripped out, though, by just looking at the rate of change in unemployed people. Historically, when the 3-month moving average of the change in unemployed people rises by over 10% on a year-over-year basis, it has resulted in recession. Currently, the year-over-year change is at 14.5%, above that threshold.

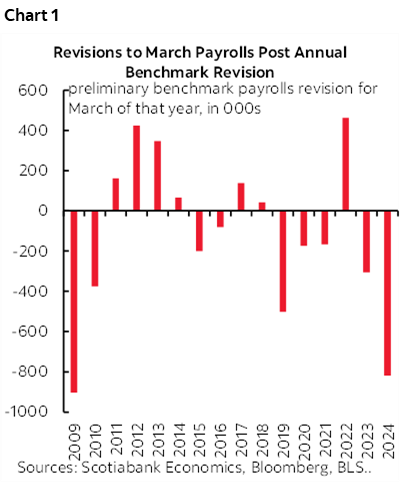

Another hit to the labor market was the announcement this week from the Bureau of Labor Statistics that it has revised down nonfarm payroll job growth for the annual period ending March 2024 by 818,000. A staggering revision that has only been outdone by 2009 during the great recession. This is part of its annual benchmark revision to the nonfarm payroll numbers, and this revision leads to a nearly 30% drop in job growth compared to what was being reported during that period.

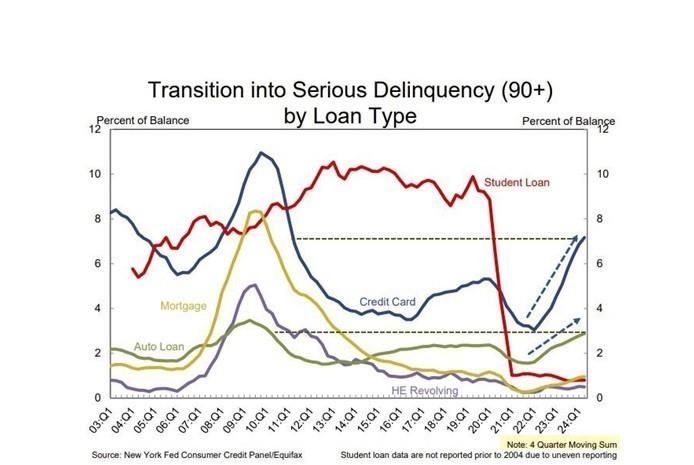

As the labor market weakens, delinquencies have continued to rise. Below is an updated chart from the last newsletter showing the trend continuing higher in delinquencies on credit cards, auto loans, and mortgages. This continues to be a bad sign for the health of the consumer.

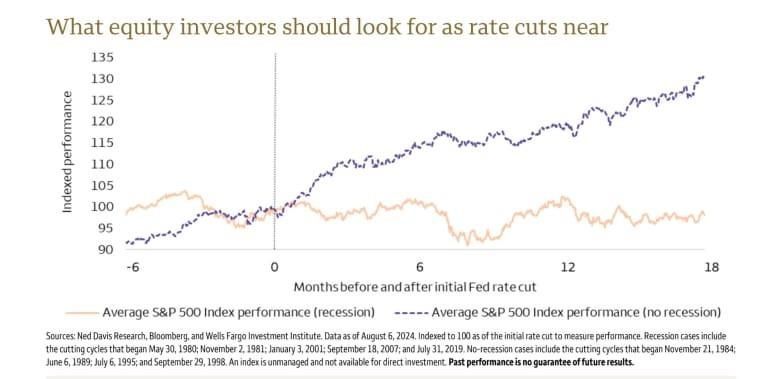

With the cracks appearing in the labor market, it gives the Federal Reserve the evidence it needs to begin cutting rates to support it. It is widely expected and being priced in by the bond market that they will cut in September by either 0.25% or 0.50%. Fed Chair Jerome Powell will give remarks from their Jackson Hole summit on Friday August 23rd and should give clues as to what the Fed is planning for September and moving forward. Those expecting interest rate cuts to be a boon for the stock market can’t be so sure. Market performance after rate cuts have begun boils down to whether the economy is in recession or not. The times where the Fed has been able to achieve a “soft landing” and reduce rates with no recession have been great periods for the stock market.

If the Fed is not too late in reducing rates, and inflation continues to abate, it could set up the stock market for another uptrend higher. As stated, though, we are coming up on a seasonally weak period for the market. A correction from here leading up to the election can be the fuel that leads to another post-election rally like we’ve seen each of the last 3 presidential cycles. The years 2000 and 2008, both election years, are the outliers where we didn’t get that post-election rally. The commonality between those 2 years obviously is that the economy was in recession. If we do not get that post-election rally and the market is in a down trending pattern, it could be that the economy has finally tipped into recession. If no recession, then this bull market could very well have another leg up. We will soon find out…

Cory McPherson is a financial planner and advisor, and President and CEO for ProActive Capital Management, Inc. He is a graduate of Kansas State University with a Bachelor of Science in Business Finance. Cory received his Retirement Income Certified Professional (RICP®) designation from The American College of Financial Services in 2017.

DISCLOSURE

ProActive Capital Management, Inc. (PCM”) is registered with the Securities and Exchange Commission. Such registration does not imply a certain level of skill or training.

The information or position herein may change from time to time without notice, and PCM has no obligation to update this material. The information herein has been provided for illustrative and informational purposes only and is not intended to serve as investment advice or as a recommendation for the purchase or sale of any security. The information herein is not specific to any individual's personal circumstances.

PCM does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional.

All investments involve risk, including loss of principal invested. Past performance does not guarantee future performance. This commentary is prepared only for clients whose accounts are managed by our tactical management team at PCM. No strategy can guarantee a profit.

All investment strategies involve risk, including the risk of principal loss.

This commentary is designed to enhance our lines of communication and to provide you with timely, interesting, and thought-provoking information. You are invited and encouraged to respond with any questions or concerns you may have about your investments or just to keep us informed if your goals and objectives change.