December 21, 2023

As we wrap up 2023, the Federal Reserve gave the markets an early Christmas present. During their December meeting they signaled an expectation of 3 interest rate cuts coming in 2024. Both the stock market and bond market exploded higher on this news in what investors view as a welcome relief from high interest rates. History tells us that interest rate cuts from the Federal Reserve aren’t always a boon to the stock market. In this newsletter, I’ll review past instances of interest rate cuts and when the stock market reacted positively and when it reacted negatively. We are also entering a presidential election year, and I’ll review how the market has done historically during those years.

How this economic and interest rate cycle will play out will depend on whether the Fed can achieve what they call their “soft landing” of the economy, or possibly no landing at all. The Fed now projects inflation continuing to cool and eventually hitting their 2% target in 2026. It seems the Fed is now more concerned about holding rates too high for too long and dampening the economy versus inflation beginning to rise again. The Fed projects GDP to continue to run in the 2% annual range, and unemployment to stay in in the 3.7%-4.0% range over the next 3 years. By 2026 they project their benchmark interest rate to be around 3% (it’s currently 5.25%-5.50%) and closer to their long-run neutral rate of 2.5%. If the Fed is somehow able to pull this off then this would be their soft landing, and that is what markets are hopeful of.

The expectation by the Fed and by the market is that they will be able to reduce interest rates gradually and smoothly over time. What history tells us, though, is that rate increases are typically done gradually over time. Rate cuts typically happen more quickly and aggressively. The last 2 cycles highlight this. After gradual increases in rates from 2015 to 2018, they were quickly cut in late 2019 and into 2020 when the pandemic hit, slashing rates to zero. From 2004 to 2006, interest rates were consistently increased by 0.25% at each meeting, eventually reaching 5%. In September 2007, interest rate cuts began as there were signs of the housing bubble popping and unemployment beginning to rise. By December 2008, interest rates were at zero.

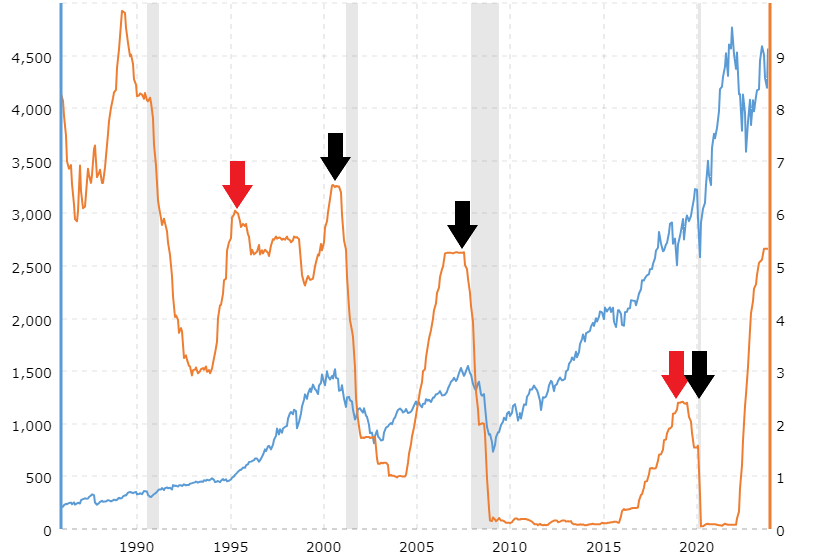

The chart below puts the Federal Funds rate on top of the S&P 500 going back almost 40 years. The black arrows show whereas the Fed was cutting rates, the stock market dropped right along with it. Those times being in 2000, 2007, and even in 2020 for a period. The red arrows are what the market is hopeful of the Fed achieving this time. In 1995 and as well as in 1998, the Fed made minor cuts that led to the economy continuing its growth and the market going higher. In 2019 when rate cuts were beginning the market had a positive reaction until the pandemic began. Overall, the expectation that interest rate cuts are coming and the market has to keep going higher because of it is most definitely not a sure bet.

Chart: macrotrends.net

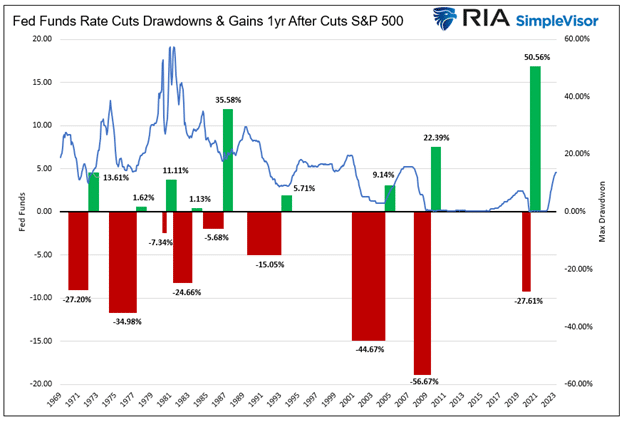

The chart below shows maximum drawdowns that have occurred during previous rate cutting cycles. It also shows forward returns 1 year after the final rate cut. As can be seen in the previous chart as well, some of the better returns and longest runways for the market happen after the Fed is done cutting rates.

A look at the current picture of the market, you can see the jump in the S&P 500 since the beginning of November. While we were expecting a rally, we were not expecting it to be of this magniture and at this pace. Many times when the market moves quickly in one direction, it can lead to a quick reversal or mean reversion. So far, we have seen just short pauses as the market continues to march higher.

Even if we do see it pullback, as long as it holds support in the 4400-4500 area, it appears it will continue to head higher and take out the all-time highs from two years ago. We very well could be in a melt-up phase in the market that sometimes signal blowoff tops. That will be something to watch in early 2024. The positives so far with this rally have been improved breadth in the market. We’ve seen small caps appear to be on the verge of breaking out finally.

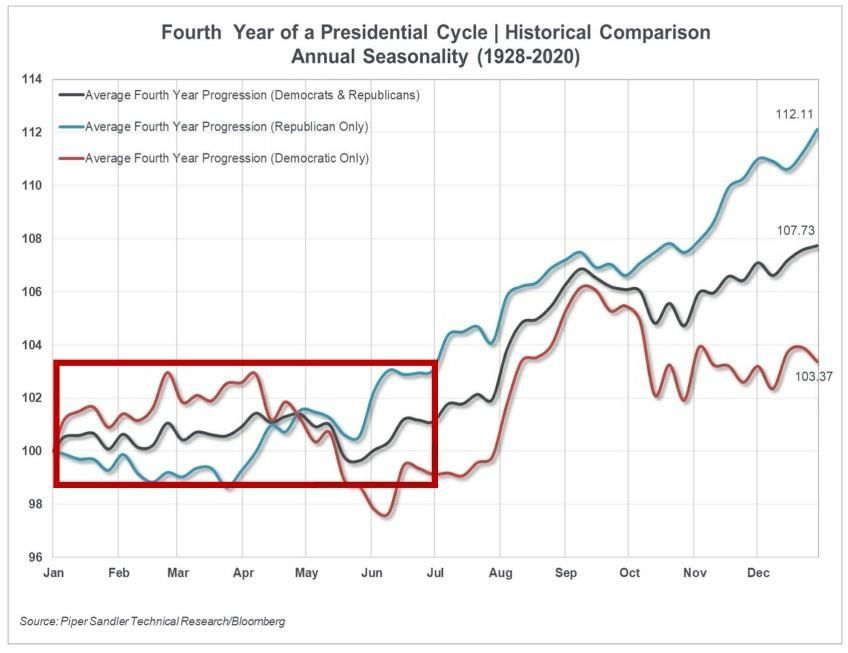

As we move into 2024, we know that it is an election year and the 4th year of the presidential cycle. History tells us this can be a volatile year. But, despite the typical volatility in an election year, the average return for the S&P during an election year is still over 7%. As you can see below, much of the gains typically happen during the second half of the year.

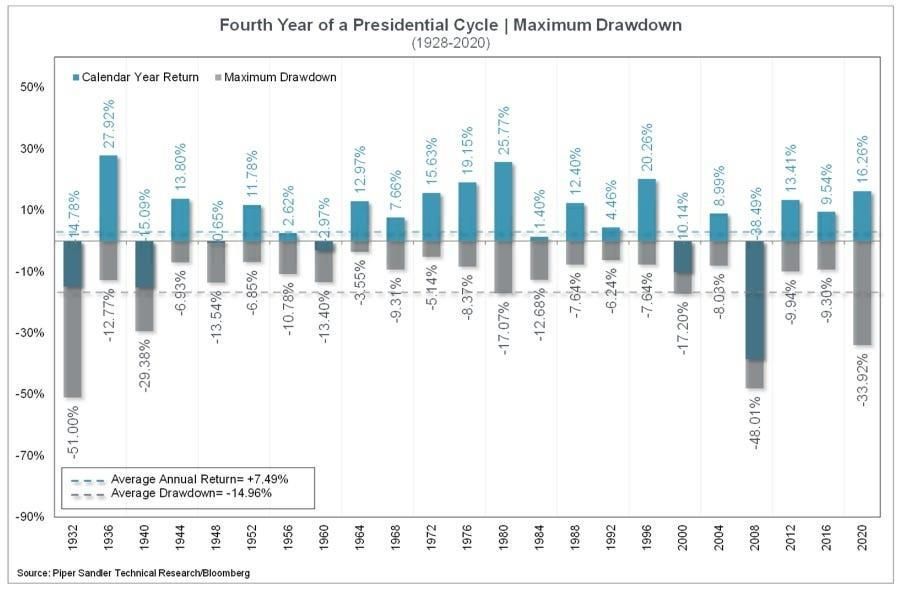

History also tells us that some of the bigger market events have occurred during election years that typically have nothing to do with the election. We don’t have to look back far as the last election year coincided with the pandemic. The chart below shows maximum drawdowns that have occurred during election years as well as the return for that year.

Going forward, there still appears to be some room to run for stocks. If interest rates continue to fall, that would benefit most bond funds as well that have suffered through a few years of interest rates rising. Does the economy finally tip into recession in 2024? Nobody knows, but it’s interesting that many of the same experts that were calling for a mild recession to happen this year and were wrong are now calling for no recession next year. As stated, election years can provide volatility as well, and I don’t expect this next one to be any different. 2024 should be another interesting year.

All of us here at ProActive Capital Management want to wish you and your family a very Merry Christmas and happy holiday season. We look forward to continuing to work with you and serve you as we turn the page to 2024.

Cory McPherson is a financial planner and advisor, and President and CEO for ProActive Capital Management, Inc. He is a graduate of Kansas State University with a Bachelor of Science in Business Finance. Cory received his Retirement Income Certified Professional (RICP®) designation from The American College of Financial Services in 2017.

DISCLOSURE

ProActive Capital Management, Inc. (PCM”) is registered with the Securities and Exchange Commission. Such registration does not imply a certain level of skill or training.

The information or position herein may change from time to time without notice, and PCM has no obligation to update this material. The information herein has been provided for illustrative and informational purposes only and is not intended to serve as investment advice or as a recommendation for the purchase or sale of any security. The information herein is not specific to any individual's personal circumstances.

PCM does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional.

All investments involve risk, including loss of principal invested. Past performance does not guarantee future performance. This commentary is prepared only for clients whose accounts are managed by our tactical management team at PCM. No strategy can guarantee a profit.

All investment strategies involve risk, including the risk of principal loss.

This commentary is designed to enhance our lines of communication and to provide you with timely, interesting, and thought-provoking information. You are invited and encouraged to respond with any questions or concerns you may have about your investments or just to keep us informed if your goals and objectives change.