Market News - November 25, 2022

November 25, 2022

November 25, 2022

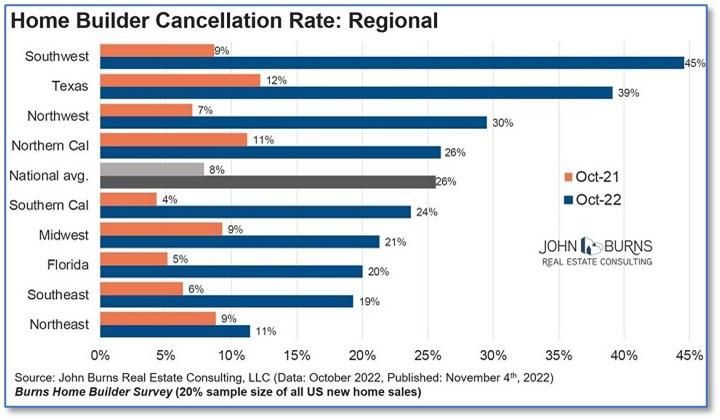

As mortgage rates continue to rise and home sales continue to slow, the next leg down of a slowing real estate market has begun—contract cancellations. The National Association of Home Builders (NAHB) has reported large drops in the traffic of prospective buyers in each of the last eight months.

June 19, 2025

While the stock market continues to remain elevated and just a few percentage points off all-time highs (S&P 500), the economy also appears to continue to chug along. A lot of the noise of tariffs that caused volatility earlier in the year has dissipated for now as trade negotiations continue. That can obviously change in a hurry. Many that were calling for imminent recession back in April have backed off that call.

May 2, 2025

What a difference a few weeks can make. While the financial media was expecting continued calamity and downside in the stock market in early April, the S&P 500 now sits at about where it was before the big drop that started on April 3rd. Does this mean we are out of the woods now and all clear? There is still a lot to prove on a technical basis as the S&P 500 has entered an important area of resistance.

April 7, 2025

It is often said the stock market takes the staircase up and the elevator down. That has clearly been seen in the action over the last few trading days as the tariff news has served as a catalyst to the downside. The S&P 500 quickly approached what pundits describe as bear market territory when it gets to a 20% drop from its high. Is this long-running bull market coming to a close?